Duplex Manifesto: Why two doors are better than one...

The Duplex Manifesto-why two bungalows are better than one.

The Duplex Manifesto-why two bungalows are better than one.

-earning monthly income and long term appreciation while you sleep.

“Every person who invests in well-selected real estate in a growing section of a prosperous community adopts the surest and safest method of becoming independent, for real estate is the basis of wealth.” -Theodore Roosevelt

Rare Form is focused on multi-family investment property, and the independence it creates for the parties that invest within it. In the past 36 months we have seen significant increases in the multi-family demand: out first acquisition on Pillsbury in 2009, inventory offered 25+ active duplexes around the lakes area under 300k at that time.

Today the times have changed, and we want to be especially candid in emphasizing the impact that going multifamily has on your wealth portfolio. The multi-unit becomes an asset as it ages, adding to your fiscal independence through the lens of the lending world.

We offer our multifamily clients the road map to handling your investment property the right way. We don't approve of slum-lord investors and operators, as we see the architecture and the history behind our buildings as a sacred thing to cherish.

Our formula is invest up front, creating properties worth keeping and tenants that derive a fiscal and emotional return. The path we have paved is one not often thought of by the gray haired scrooge style investors: modern kitchens & baths with classical restoration of woodwork, built-ins, and hardwood flooring.

Nearly all craftsman era kitchens within south Minneapolis were lined with amazing Douglas fir subfloors, which offers a great linden hills chic to the space. Linoleum represents the worst era in architecture, remove it as our hardwood restorer will tell you!

“Buying real estate is not only the best way, the quickest way, the safest way, but the only way to become wealthy.” -Marshall Field

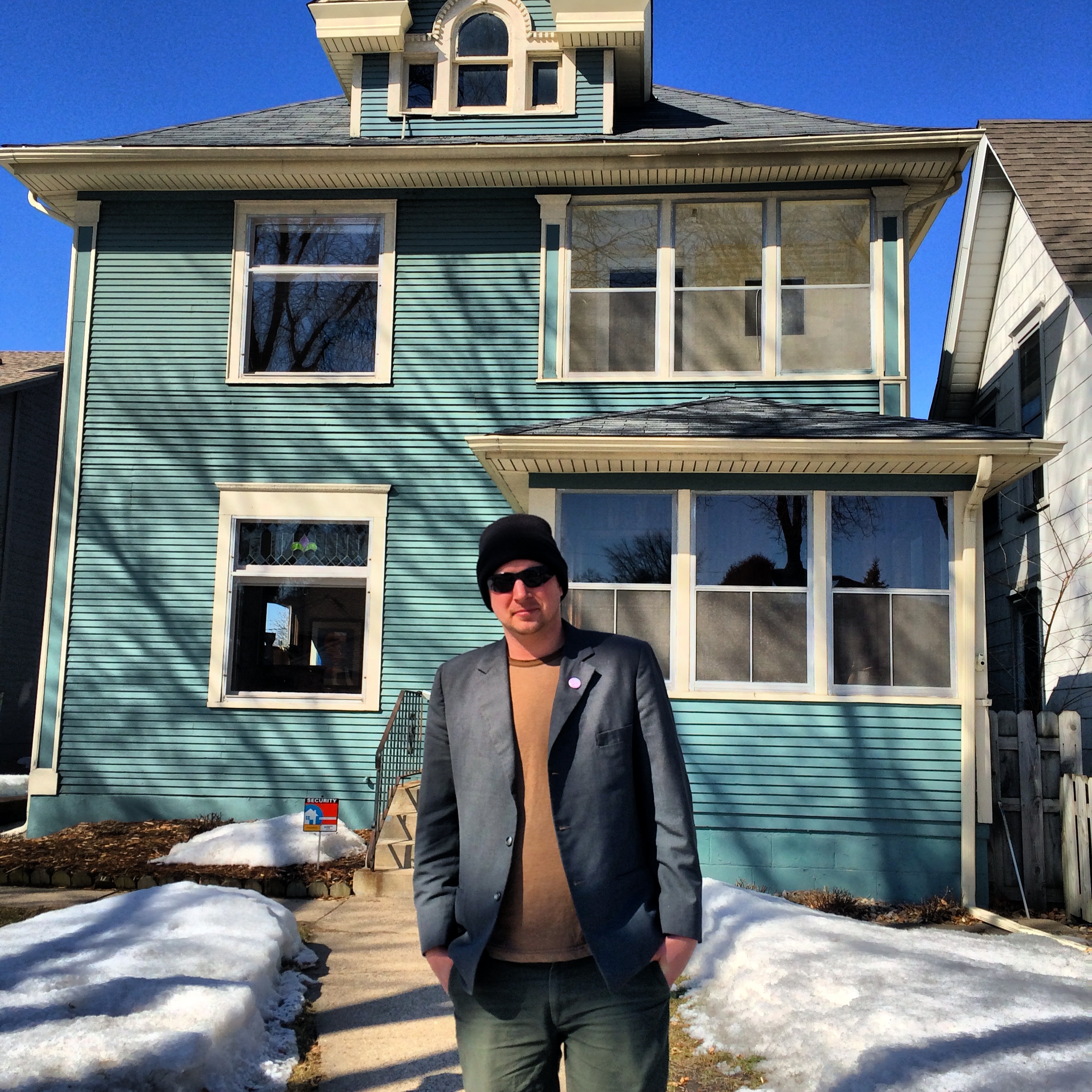

Chris Albertson lives out on Lake Minnetonka, he is now in the process of aligned a holding company to purcahse and restore a portfolio of rental properties. Below is a shot of him entering a condemned building on 36th and Lyndale, of which the door knob came off when he tried to enter! This building was listed for 110k, and the highest bidder landed it at 200,000. This was quite an offer for a building filled with freeze damage and caved in flat roof.

Steve jumped on this Sheridan NE duplex in minutes. Original leaded glass, woodwork, and charm for miles. The post closing plan is kitchen and bath updates to bring the building rents to 2700 per month.

The up/down duplex near King's wine bar sold in 2012 in the 260's. Average rents for this floorplan are between 1250-1450 per unit. This is one of Kingfield's finest locales, and this properties similar to this one are certain to be worth upwards of 500k if handled properly.

This Logan Park Fourplex sold in NE in 2013 in the 270's. Market rents for these units are 750-900 for each, generating building gross income of 3600 monthly once updates are completed. This particular location offers a ton of upside and rents in NE are sure to escalate as the community and culture continues to thrive.

Aaron & Amber secured an amazing property in North Minneapolis, nestled along the west side of Theodore Wirth Park. They are now in the process of moving the existing tenants out and selecting new life for both units. This is a rarely conditioned investment property that benefited from a meticulous owner of over 25 years.

This Duplex in Uptown was proudly redone by one of our very first investor clients. He is now seeking his next property in Minneapolis after achieving a cruise control status on his first duplex with both units occupied long term.

We are focused on up and coming fourplex areas. This includes Nokomis, Longfellow, Whittier, and even Powderhorn. This one below sold in the 360's and will be a nice cash flowing property at 4x 2 bedroom classic units.

This Whittier 4 plex is steps from MCAD, and walking distance to the budding eat street. We see this area as having a very bright future in the rental markets. This building sold for 350k with rents ranging from 800-850 per unit.

47th & Blaisdell- a street that is near and dear to our heart- bank owned REO duplex in Tangletown, oddly left for dead by and overstretched investor. This home sold in the 250's in 2013 and will serve as a wonderful addition to someone's balance sheet at 2800 monthly revenue.

This was one of the last great purchases in the downturn; it sold for 220 in 2013. This up/down duplex is steps from the 38th and Grand corner of Rincon & Victors. This first time investor is set to dial in some nice cash flow and learn the ropes of managing a rental property. We stayed with him at every step, first tackling the cleanup and cosmetic revival and are presently working towards leasing the units.

A rear patio addition to the common areas is another value added addition that we see as a difference maker in the rental markets. Creating an outdoor space with fences and patios are critical to attracting the upper crust of leasing clientele. This is a far cry from the common chain link and ratty plastic chairs commonly seen throughout the duplex blocks in Minneapolis.

There are many approaches to multi-unit investments. We have targeted a number of areas as having condo conversion potential, following the wake of some of the area best neighborhoods. Lowry Hill, Crocus, and Linden Hills all have current condo conversions lining the most coveted blocks within the areas. Part of our long term investment strategies for our clients, includes seeking areas of future development. A duplex with a basis of 90-130k per unit becomes a 250-300k condo unit.

Rare Form's first duplex is on Pillsbury just south of Uptown. We renovated the kitchens and baths, refinshed sadly neglected woodwork and floors, and restored the exterior with the help of Ben & Imhoff Painting. Since 2009 we have had the pleasure of having the same amazing tenants enjoy the light filled space and huge back lawn. The lessons learned on this property became the basis for our investment model that we share with all of the Rare Form community.

Immediately after purchase and prior to initial lease, we invested 8k in an intelligent kitchen remodel. We removed the old farm sink, added a dishwasher and a bank of Ikea cabinets with a 25 year warranty. All appliances are refurnished from Gary's Appliance. Creating spaces like this one are the key to easy management and happy tenancy which in turn eliminates vacancy risk.

Below is a snapshot of our most recent bank owned Kingfield acquisition. Acquired in the 180's, this property needs significant restoration. Prior to closing we have established contracts to have both bathrooms gutted and renovated, all woodwork enameled and restored, and kitchens revamped. We are targeting a build-out timeline of 21 days, most likely have leases on both units at 1350 prior to completion.

Stay tuned for Duplex Top Ten key tips when investing and operating a rental property. #Kingfield #DuplexMinneapolis #Rareformproperties #Projectdoublebungalow